One of the most beautiful things about on-chain analysis is that it lets you see what others can’t see. It turns invisible market sentiment into data you can act on — long before it shows up on Twitter.

The Setup: Smart Money Moves Before the News

A few hours before the news broke that Trump would pardon CZ, an alert from Nansen caught my attention. Smart Money wallets were moving – quietly, but aggressively.

After validating the flows and aligning them with my thesis, I opened a long position on $4USDT.

Closed in 200% profit.

You’d think that would be the end of it, right? Not quite.

A Clue Hidden in the Data

Once the long trade closed, I went back to dig through the on-chain data again. Among several metrics, one thing stood out clearly:

Exchange inflows of $1.7M in the last 24 hours – more than 2× the normal average.

That’s usually a red flag. When tokens are moving into exchanges, it often signals upcoming selling pressure.

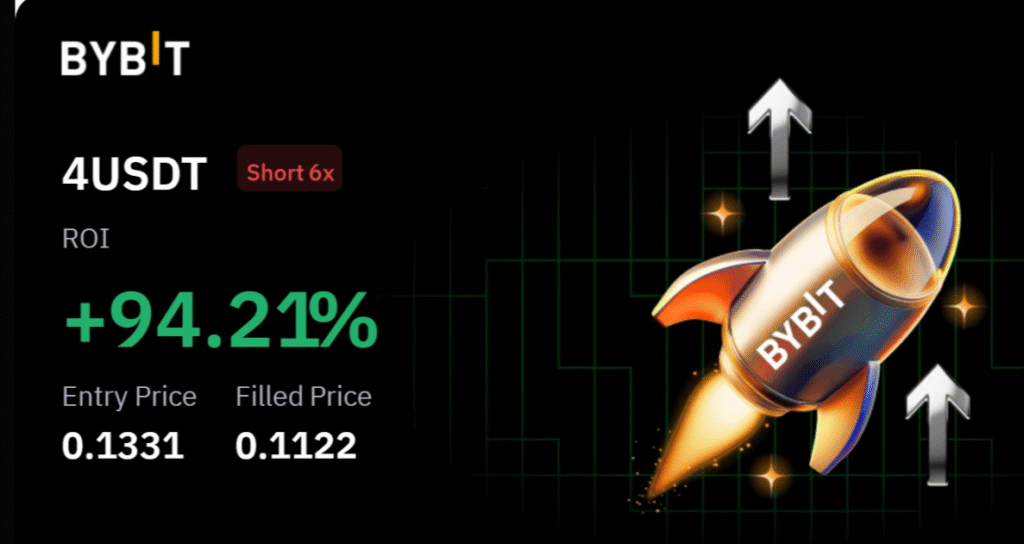

So, I flipped my bias. Opened a short position.

Closed in 94% profit

Warning: Don’t Trade Emotion for Logic

Here’s something I’ve learned – and re-learned – over years of trading: Just because you closed a short doesn’t mean you should instantly go long.

Or the other way around.

If you flip bias without a thesis, you’re not trading with data anymore – you’re trading with emotion. And when emotion replaces logic, the market will take back everything it gave you.

Key Takeaway

On-chain analysis gives you what traditional charts can’t – visibility into intent.

By following Smart Money flows, you don’t need to predict the future. You simply read the footprints of those who already know it.